One of the concepts I love about FIRE is that it admits there's no one perfect number for how much one needs to retire. The FI number depends totally on your annual expenses. History has suggested that if you invest a sum of money in a whole stock market index fund, you can withdraw 3-4% of it or so every year and it will grow to make up for it. This means you need to save up enough so that the 4% pays for your annual expenses.

The FIRE community started dividing up into camps based on how much they needed.

LeanFIRE: Households determined to live off less than $40,000 a year

FatFIRE: Households saving up enough to withdraw $100,000 a year

It's easy to divide these amounts by 4% (or multiply by 25, same thing) to see the total amount needed.

So how can you save up this much? I am going to recommend the FV() spreadsheet function.

value = FV(rate, number of payments, payment amount, starting amount)

For example... let's say I have $800 a month to invest. That's over everything. My RothIRA, 401K, HSA (if I'm not using it), savings, whatever. How much would I have in 10 years?

payment = FV(5%/12, 12*10 years, 800, 0)

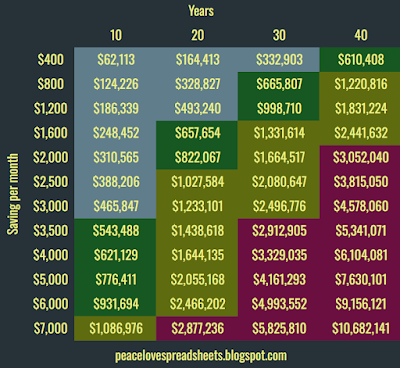

Here's a table with a few selected monthly savings rates, so you can see the various levels you'd achieve.

You'll probably notice that it takes really aggressive savings to achieve any realistic kind of FIRE number after 20 years, but the math is there, and you can always reduce your spending, lower your FIRE number, and lower your years to get to it.

Comments

Post a Comment