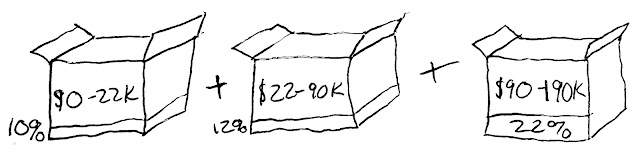

Tax brackets scare people. They think that as soon as you're in the "24% tax bracket", your entire income will be taxed at 24%. They think that if you're $1 into the next one, you'll lose money. This is not true.

Tax rates only affect the income in that tax bracket. In other words, if you go $1 into that 24% tax bracket, you're going to have to pay 24% of that $1 in taxes. Not 24% of the rest of your income. The rest of your income is taxed at 10%, 12%, and 22%.

For example, here is the 2023 Married Filing Jointly schedule:

| Rate | Range | Tax |

|---|---|---|

| 10% | $0 - $22,000 | 10% within bracket |

| 12% | $22,001 - $89,450 | $2,200 + 12% within bracket |

| 22% | $89,451 - $190,750 | $10,294 + 22% within bracket |

| 24% | $190,751 - $364,200 | $32,580 + 24% within bracket |

| 32% | $364,201 - $462,500 | $74,208 + 32% within bracket |

| 35% | $462,501 - $693,750 | $105,664 + 35% within bracket |

| 37% | $693,750 and plus | $186,602 + 37% within bracket |

I like to think of it as chunks. Let's say you make $110,000. That means:

- $22,000 is taxed at 10% = $2200

- $67,450 is taxed at 12% = $8094

- The last $20,550 is taxed at 22% = $4521

- Total tax: $14,815, or about 13%. Not 22%.

Another good way to think of it - let's look at two people who are "in different brackets". One makes $89,000 and the other makes $90,000.

Person 1 earns $89,000

- $22,000 taxed at 10% = $2200

- $67,000 taxed at 12% = $8040

- Total tax: 2200 + 8040 = $10,240

- Take home: $89,000 - $10,240 = $78,760

- $22,000 taxed at 10% = $2200

- $67,450 taxed at 12% = $8094

- $549 taxed at 22% = $121

- Total tax: 2200 + 8094 + 121 = $10,415

- Take home: $90,000 - $10,415 = $79,585

Of course consult your tax professional, I am not giving advice just telling you some ideas I use for myself. But you can see here that as you make more dollars, you'll never LOSE money. That 12% chunk where you pay $8094 is the same whether you make $89451 (the bottom of the 22% bracket) or millions of dollars.

Comments

Post a Comment